Browse Your Finances with Professional Loan Service Assistance

Browse Your Finances with Professional Loan Service Assistance

Blog Article

Explore Specialist Financing Providers for a Seamless Borrowing Experience

Professional finance solutions provide a path to navigate the complexities of borrowing with precision and know-how. From tailored lending options to tailored guidance, the world of specialist car loan solutions is a world worth checking out for those looking for a borrowing trip noted by effectiveness and convenience.

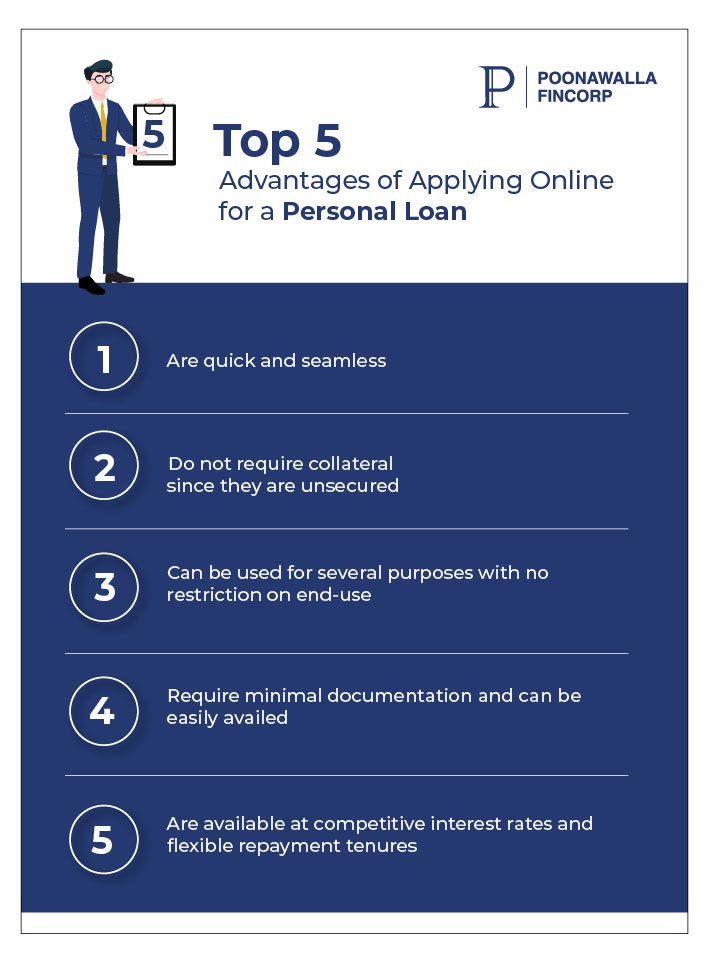

Benefits of Expert Finance Solutions

Professional car loan services use proficiency in browsing the facility landscape of loaning, supplying tailored solutions to satisfy certain economic demands. Professional funding solutions typically have actually established partnerships with lenders, which can result in faster authorization processes and far better arrangement end results for consumers.

Picking the Right Loan Supplier

Having actually acknowledged the benefits of specialist car loan services, the next vital action is selecting the ideal financing supplier to meet your details financial requirements efficiently. mca lending. When selecting a financing supplier, it is necessary to take into consideration several key variables to ensure a seamless loaning experience

Firstly, review the track record and reputation of the car loan carrier. Research study client evaluations, scores, and testimonials to gauge the contentment levels of previous consumers. A reputable car loan provider will have clear conditions, excellent customer support, and a track record of dependability.

Second of all, compare the interest prices, charges, and payment terms supplied by various lending carriers - merchant cash advance loan same day funding. Search for a provider that uses competitive rates and versatile repayment alternatives tailored to your economic circumstance

In addition, take into consideration the loan application process and authorization duration. Choose a service provider that provides a structured application procedure with quick approval times to accessibility funds quickly.

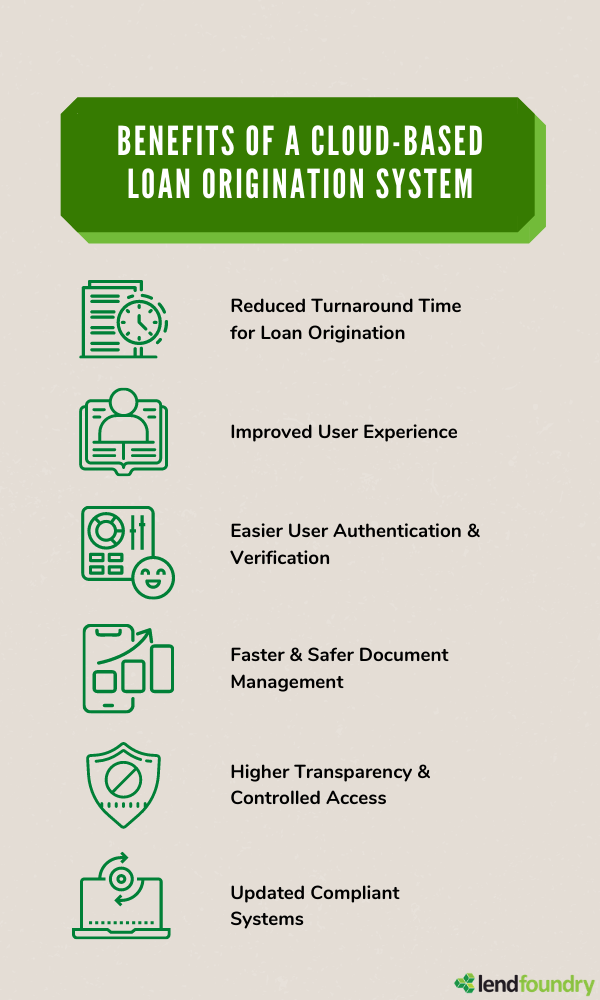

Streamlining the Application Refine

To improve performance and ease for applicants, the car loan supplier has actually carried out a streamlined application process. One crucial feature of this structured application process is the online system that allows candidates to submit their info digitally from the convenience of their own homes or offices.

Comprehending Loan Terms and Problems

With the structured application procedure in area to simplify and expedite the borrowing experience, the following crucial action for applicants is acquiring a thorough understanding of the finance conditions. Understanding the conditions of a funding is vital to make sure that consumers know their responsibilities, rights, and the overall cost of borrowing. Key elements to take note of consist of the rates of interest, payment routine, any type of connected costs, charges for late repayments, and the overall amount repayable. It is vital for debtors to very carefully examine and understand these terms before accepting the funding to prevent any surprises or misunderstandings in the future. Furthermore, customers ought to ask about any type of provisions associated to early payment, re-financing alternatives, and prospective modifications in rate of interest in time. Clear communication with the loan provider pertaining to any uncertainties or queries regarding the terms is motivated to promote a clear and check it out equally beneficial borrowing partnership. By being well-informed about the lending terms, consumers can make sound financial choices and navigate the borrowing process with self-confidence.

Optimizing Lending Approval Possibilities

Securing authorization for a lending requires a calculated method and comprehensive prep work for the borrower. To make best use of lending approval possibilities, people must begin by examining their credit scores reports for precision and attending to any kind of disparities. Maintaining a good credit history rating is critical, as it is a significant aspect thought about by lending institutions when analyzing creditworthiness. Additionally, reducing existing financial obligation and preventing tackling new financial obligation before obtaining a loan can demonstrate financial obligation and boost the likelihood of authorization.

Additionally, preparing an in-depth and practical spending plan that outlines revenue, costs, and the suggested finance payment plan can showcase to lenders that the borrower can taking care of the added monetary obligation (mca lenders). Offering all needed documents promptly and accurately, such as proof of earnings and work background, can simplify the authorization process and instill confidence in the lending institution

Verdict

To conclude, specialist financing solutions use numerous benefits such as expert advice, customized car loan alternatives, and boosted authorization possibilities. By selecting the appropriate car loan service provider and understanding the terms, borrowers can streamline the application process and make sure a seamless loaning experience (Loan Service). It is very important to carefully take into consideration all facets of a loan prior to dedicating to ensure economic stability and successful settlement

Report this page